Nearly 30 provinces have clearly defined the courts for accepting the crude oil treasure incident, and investors have ushered in the dawn?

Beijing, August 2 (Zhang Xu)-The Bank of China’s crude oil treasure incident has finally made new progress. As of press time, local courts in nearly 30 provinces have issued announcements that "crude oil treasure" investors can sue according to the relevant territorial principle.

"I will not accept reconciliation and will insist on safeguarding my legitimate interests by law." A "crude oil treasure" investor who successfully filed a case told Zhongxin.com that his attitude also represents the views of most people in the investment crowd.

Nearly 30 provinces have clearly accepted the court.

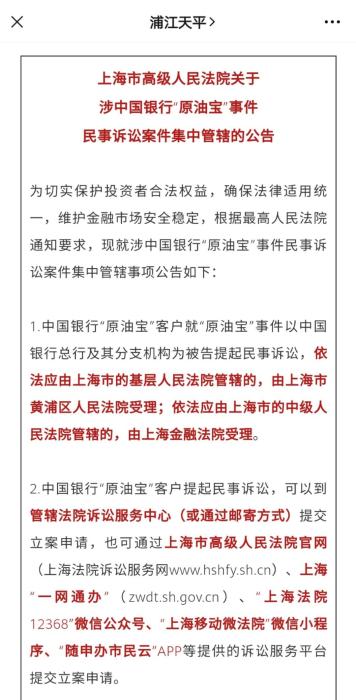

On July 28th, the Shanghai Higher People’s Court published an announcement on the official WeChat official account "Pujiang Tianping" about the centralized jurisdiction of civil litigation cases involving the "crude oil treasure" incident of China Bank.

The picture comes from the official micro-signal of Shanghai High Court.

According to the announcement, the customer of China Bank’s "Crude Oil Treasure" filed a civil lawsuit against the head office of China Bank and its branches, which should be under the jurisdiction of the basic people’s court in Shanghai according to law and accepted by the people’s court of Huangpu District in Shanghai; If it should be under the jurisdiction of the Shanghai Intermediate People’s Court according to law, it shall be accepted by the Shanghai Financial Court.

According to incomplete statistics, as of press time, the Higher People’s Courts of at least 27 provinces have announced the centralized jurisdiction of the civil litigation cases of the Bank of China’s "Crude Oil Treasure" incident, including: Beijing, Shanghai, Chongqing, Guangdong, Guangxi, Fujian, Hebei, Henan, Hunan, Hubei, Liaoning, Heilongjiang, Jilin, Zhejiang, Jiangsu, Guizhou, Shanxi, Shaanxi, Ningxia, Xinjiang.

It is worth noting that the announcements of the high courts in most provinces show that the jurisdiction is classified according to the amount of litigation subject matter, and the announcement is applicable to the "crude oil treasure" customers of China Bank within their provinces. The announcements issued by the Beijing and Shanghai Higher People’s Courts did not mention the classification of jurisdiction according to the amount of litigation, and at the same time, the scope of application was wider, which was "China Bank ‘ Crude oil treasure ’ Customers ".

Lawyer: Centralized jurisdiction of cases can unify the judgment scale.

Beijing is the headquarters of China Bank. Can investors from other provinces institute legal proceedings against the head office of China Bank? In this regard, Jiang Zhenxiang, vice president of Bijie Lawyers Association, gave a positive answer.

Jiang Zhenxiang told Zhongxin. com: "According to Article 23 of the Civil Procedure Law, a lawsuit brought due to a contract dispute shall be under the jurisdiction of the people’s court of the defendant’s domicile or the place where the contract is performed. According to this regulation, ‘ Bank of China crude oil treasure ’ Disputes are contract disputes. If the parties from other provinces rank BOC as the first defendant, they can bring a lawsuit to the court in Beijing. "

Data Map: Exterior location of China Bank. China News Agency issued Wang Dongming photo

What is centralized jurisdiction and why should it be centralized? Wang Jianbiao, an equity partner lawyer of Beijing Zhongwen Law Firm, told Zhongxin. com that centralized jurisdiction by region is a provision made by the court to improve efficiency and unify judgment standards.

"It is estimated that the designated court will have special judges to hear cases involving crude oil treasures, and the final judgments may be consistent. In addition, from the report, the Supreme People’s Court has unified and coordinated the trial of crude oil treasure cases in various provinces. It is estimated that judges in various provinces will also organize some national conferences to unify the referee standards. " Wang Jianbiao judgment.

There are investorsThe prosecution was accepted by the court.

At present, it has been more than three months since the US WTI crude oil futures 2005 contract appeared negative settlement price on April 20th, and the reconciliation between some investors and China Bank is in a stalemate.

Judging from the situation of Zhongxin. com, investors’ attitudes are also different. Among them, some investors with small losses or eager to reduce losses have successively signed settlement agreements. The content of the agreement is that China Bank will compensate the investor for 20% of the principal, and the negative part will be borne by China Bank.

In May, the relevant person in charge of Bank of China revealed to the media that the rate of signing contracts with customers has exceeded 80%, and the links and processes such as product design, business strategy and risk control are being comprehensively reviewed.

Two months have passed since May, and investors who did not settle at the beginning are still insisting. "BOC has been urging me to sign a settlement agreement in recent months, saying that the compensation plan is the policy formulated above, and they can’t do it. I advocate full compensation, even if it can’t be fully compensated, it must be investigated clearly, otherwise this kind of thing may happen again in the future. " Some investors said.

There are two main reasons why some investors are unwilling to reconcile: First, in the process of negotiation between BOC and investors after the incident, there were acts of bullying customers in some areas, which disgusted investors; Second, the compliance and risk control of the product design of "Crude Oil Treasure" can not be accurately answered, and investors believe that it is illegal.

In the crude oil treasure investment crowd, many people chose to file a lawsuit. In fact, long before the local higher people’s court issued an announcement, investors had successfully filed a case.

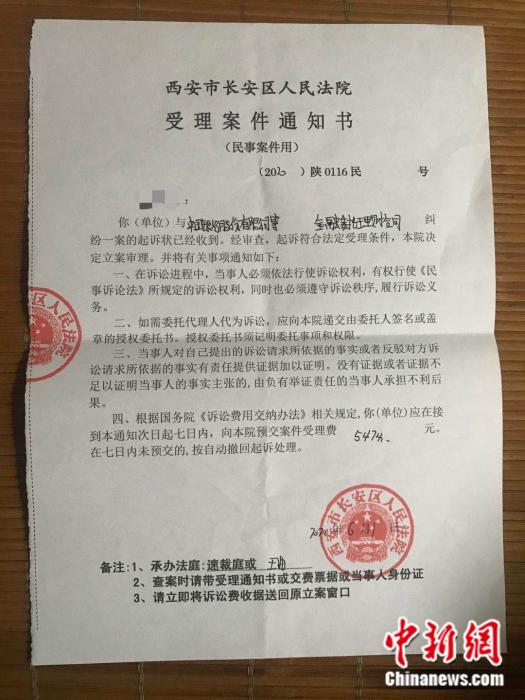

Notice of filing acceptance issued by the investor. Photo courtesy of respondents

The notice of acceptance of the case by the People’s Court of Chang ‘an District, Xi ‘an issued by the investor Mr. Wang shows that the court has accepted the dispute between the investor and China Bank Co., Ltd. over the financial entrusted financing contract, and the lower right corner date is June 1, 2020.

Mr. Wang said that the filing process was relatively smooth. He filed an application on June 1 and the court filed the case on the same day. "My principal is $30,000, which is totally lost. According to the announcement of the Bank of China, I still owe the bank hundreds of thousands. Because I can’t accept the attitude and behavior of the other party in the past three months, I will not accept the so-called reconciliation and will insist on safeguarding my legitimate interests by law. "

In the indictment, Mr. Wang believes that there are many irregularities in China Bank, including false propaganda, misleading investors into thinking that crude oil treasure is a wealth management product; Failure to fulfill the obligation of appropriateness and explanation leads investors to buy futures products with unlimited risks.

"According to Article 52 of the Contract Law, China Bank has so far been unable to provide legal materials for crude oil treasures. According to Article 18 of the Interim Measures for the Administration of Derivatives Trading in Banking Financial Institutions, banking financial institutions are not allowed to independently hold or sell naked short-selling derivatives that may cause unlimited losses to customers, as well as derivative products based on assets or linked indicators."

Mr. Wang said that according to the product description of China Bank’s crude oil treasure, BOC crude oil treasure is a derivative product linked to the Chicago Stock Exchange index and should be regulated by the prohibitive rules of the Interim Measures.

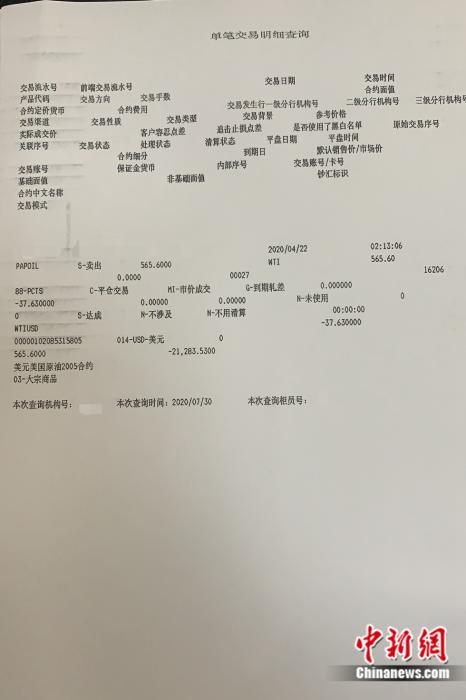

Enquiries on transaction details provided by the interviewee Mr. Wang.

Due to the early filing time, Mr. Wang thought that his case would be the first batch of crude oil treasure litigation cases in China, but two months later, the local court did not give more answers except "waiting for notice".

As of press time, among the hundreds of investors, only Mr. Wang has successfully filed a case. Although the trial has not yet started, it is still an encouragement to others. "Before there was a law with crude oil treasure, I was silent halfway, and recently I said it was acceptable. I have met a few and haven’t found a suitable lawyer yet, but I will continue. " Some investors said.

New situation

— — The system failure caused the investor a loss of 400,000 yuan. Can the bank be exempted?

On April 9th, Mr. Li of Handan, Hebei Province bearish on 750 barrels of crude oil around March 1997-200 yuan. After the "Crude Oil Treasure" transaction, the banking system of China collapsed, and it was impossible to inquire whether the transaction was successful. The system showed that the margin was zero and the number of barrels held was zero. Similar situations have occurred twice, and Mr. Li lost a total of more than 400,000 yuan.

The crude oil treasure system crashed and could not land. Photo courtesy of respondents

Yongnian Sub-branch of Bank of China said in a written reply, "After investigation, due to the recent huge fluctuation of crude oil prices that has never happened in decades, there was a special situation in which a large number of customers poured in and the transaction volume suddenly surged at a certain time. Due to network communication congestion, some customers may fail to log in at a certain time or the transaction was unsuccessful due to a large queue." Bank of China also stated that it is not responsible for the losses caused by system risks and communication risks.

Mr. Li can’t accept this and is still seeking a court case. Like him, there are more than 100 investors who have suffered system collapse.

System failure prevents customers from trading, can banks be exempted?

"If the system failure is caused by force majeure, if both parties are not at fault, it is fair for the losses caused to be shared equally by the buyers and sellers. If the system failure is not caused by force majeure factors, but is caused by inadequate system maintenance, untimely or operational errors, then the losses caused by it should be borne by the party responsible for system maintenance. " Jiang Yuxiang said.

— — A number of banks suspended the opening of precious metals.

A few days ago, a number of domestic banks issued notices to customers that they would suspend the opening of precious metals in their accounts on the grounds that the international prices of platinum and palladium have fluctuated frequently and violently recently.

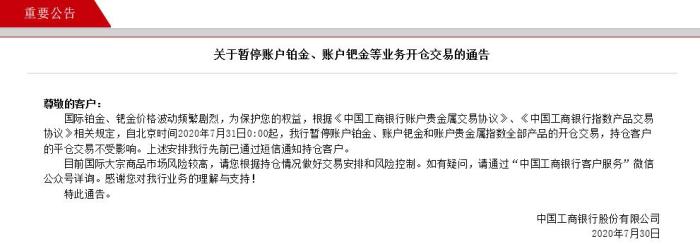

ICBC said that in order to protect customers’ rights and interests, starting from 0: 00 on July 31, 2020, Beijing time, the bank suspended the opening trading of all products of platinum, palladium and precious metal index, and asked customers to make trading arrangements and risk control according to their positions.

Icbc announcement. Picture from official website

In addition, the opening transactions of platinum and palladium in the accounts of Agricultural Bank of China, Bank of Communications and Minsheng Bank were respectively pressed by the pause button. Among them, the Agricultural Bank of China will stop the opening trading service of platinum and palladium varieties from 8: 00 am on August 10, 2020, Beijing time, and the closing trading of customers with positions will not be affected.

The Agricultural Bank said, "Due to the spread of the Covid-19 epidemic and the loose global monetary policy this year, the prices of platinum and palladium fluctuated sharply, the market liquidity deteriorated significantly, and the trading risk increased."

The market generally believes that a number of banks have suspended the trading of precious metals in their accounts, which may be due to the lessons learned from the previous crude oil treasure incident. However, in addition to market risks, some customers reported that they suffered losses due to banking system failures.

Investors reflect the collapse of precious metal trading system of China Merchants Bank. Weibo screenshot

"On July 28, the two-way gold and silver trading system of China Merchants Bank collapsed. At about 11: 30 in the morning and from 3: 30 to 4: 00 in the afternoon, when precious metals dived, the system entered the market or made deposits or inquired about positions, and it was unable to trade." Some investors said.

For this kind of situation, Wang Jianbiao said, "The judgment standard of the court is relatively strict. Investors should first prove that the inability to sell was caused by system failure, and second, prove that they wanted to sell at that time. If the above two proofs can be established, the loss can be compensated by the party that caused the system failure. "