One place plans to issue bonds of 66.32 billion yuan, all of which will be used to repay the debts owed to enterprises.

On September 26th, the information of the refinancing general bonds (9-11) of the Inner Mongolia Autonomous Region government was disclosed, and the total amount of the three bonds to be issued was 66.32 billion yuan.

It is worth mentioning that of the three bonds issued this time, the use of the funds raised in the ninth phase is clearly defined as "all the debts owed by the government for repayment", and the use of the tenth and eleventh bonds is clearly defined as "all the debts owed by the government for repayment before 2018".

Inner Mongolia issued 66.32 billion bonds.

Used to repay debts owed to enterprises.

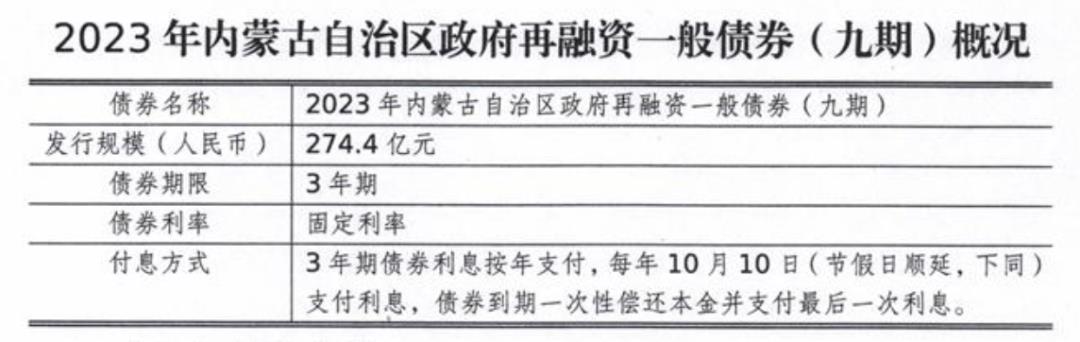

On September 26,Inner Mongolia Autonomous Region government refinancing general bondsDisclosure of information related to the ninth to eleventh issues. According to the disclosure documents, the total amount of the three bonds to be issued is 66.32 billion yuan. Specifically, the issuance amounts are 27.44 billion yuan, 19.44 billion yuan and 19.44 billion yuan respectively, and the bond maturities are 3 years, 7 years and 5 years respectively.

The interest on the bonds shall be paid annually, and the interest shall be paid on October 10th every year (postponed on holidays). The principal of the bonds shall be repaid in one lump sum and the last interest shall be paid. After issuance, it can be circulated in the national inter-bank bond market and the stock exchange bond market according to regulations.

According to the information disclosure documents, this round of refinancing general bonds were issued through bidding. On the tender day, the bidding work is organized through the "Government Bond Issuance System of the Ministry of Finance", and the members of the Inner Mongolia Autonomous Region Government Bond Underwriting Group from 2021 to 2023 are eligible to participate in the first issuance bidding.

It is worth mentioning that the three issues of Inner Mongolia Autonomous Region government refinancing general bonds issued this time,Among them, the purpose of the ninth bond is clearly defined as "all the funds raised will repay the debts owed by the government to the enterprise",The purpose of the tenth and eleventh issues of bonds is clearly defined as "all the raised funds will repay the outstanding corporate accounts recognized by the government before 2018"..

In this regard, Feng Lin, a senior analyst of Oriental Jincheng Research and Development Department, said in an interview with national business daily that there may be two meanings here: First, it is the concrete implementation of the Special Action Plan for Clearing Outstanding Enterprise Accounts adopted by the the State Council executive meeting on September 20th. Second, this means that the hidden debts of local governments include not only the financial debts of the city investment platform, but also the accounts owed to enterprises.

According to the debt situation of the whole region disclosed by the Finance Department of Inner Mongolia Autonomous Region, the government debt balance of the whole region in 2022 was 933.97 billion yuan. From the source of funds, 932.88 billion yuan of government bonds were issued, accounting for 99.88%; BT, arrears of project funds and other payables are 149 million yuan, accounting for 0.02%; Other debts such as loans from international economic organizations and foreign governments amounted to 951 million yuan, accounting for 0.10%. Judging from the future repayment, it will be 125.27 billion yuan in 2023 and 808.7 billion yuan in 2024 and beyond.

In addition, the Finance Department of Inner Mongolia Autonomous Region disclosed that in terms of local economic conditions, the regional GDP of Inner Mongolia Autonomous Region in 2022 was 1,449.15 billion yuan. In terms of fiscal revenue and expenditure, 1-mdash in 2022; In December, the general public budget revenue of the whole region was 282.44 billion yuan, an increase of 47.44 billion yuan or 20.2% over the previous year. The general public budget expenditure in the region was 588.77 billion yuan, an increase of 64.814 billion yuan or 12.4% over the previous year. The revenue of government funds in the whole region was 40.77 billion yuan, a decrease of 9.72 billion yuan or 19.3% over the previous year. The expenditure of government funds in the whole region was 67.85 billion yuan, a decrease of 7.12 billion yuan or 9.5% over the previous year.

Conducive to reducing the hidden debt stock.

Is the refinancing bond issued by the Inner Mongolia Autonomous Region Government a special refinancing bond? What is the difference between special refinancing bonds and refinancing bonds?

Nie Zhuo, a lecturer in the Finance and Taxation Department of university of international business and economics Institute of International Economics and Trade, said that ordinary refinancing bonds and special refinancing bonds are local government bonds that the budget law stipulates that local governments can legally issue within the debt limit approved by the National People’s Congress. The difference between them lies mainly in their different purposes. Ordinary refinancing bonds are used to repay the principal of local government bonds due, andSpecial refinancing bonds are used to repay other debts besides the explicit debts of local governments, including the implicit debts of existing stocks.. Therefore, the refinancing bonds issued by the Inner Mongolia Autonomous Region government this time belong to special refinancing bonds.

Feng Lin also mentioned that special refinancing bonds are refinancing bonds issued by local governments. Different from ordinary refinancing bonds, the funds raised by special refinancing bonds are used to repay the principal of government bonds due, and the funds raised by special refinancing bonds are used to replace local implicit debts.That is, to make hidden debts explicit..

"The issuance of ordinary refinancing bonds will not lead to an increase in the balance of explicit debts of local governments, because only the expired explicit debts will be replaced by newly issued refinancing bonds; The issuance of special refinancing bonds will reduce the implicit debt stock and increase the explicit debt balance. " When talking about the difference between the two, Nie Zhuo said.

Feng Lin further pointed out that from the past practice, the explicit hidden debt is a debt-dissolving method with less resistance and obvious short-term results. Therefore, after Politburo meeting of the Chinese Communist Party proposed to "formulate and implement a package debt-dissolving scheme" on July 24th, the market generally expected that the special refinancing debt used to replace hidden debt would be re-issued and would become an important measure in the package debt-dissolving scheme.

Nie Zhuo said that the issuance of special refinancing bonds has two meanings for resolving local debts. First, special refinancing bonds transform high-interest and opaque implicit debt into low-interest and transparent regulatory debt, which directly reduces the debt risk of local governments. Second, the issuance of special refinancing bonds uses the local government debt limit approved by the National People’s Congress in the past but not used by local governments, which will not break through the current local government debt limit management principle, so the implementation cost is small.

When talking about the historical issuance scale of refinancing bonds, Nie Zhuo said that refinancing bonds were first issued in December 2020 when the pilot project to resolve the hidden debt risk of the county was fully launched, and all of them were issued in September 2021, with a total amount of 612.8 billion yuan. Subsequently, a total of 504.18 billion yuan of special refinancing bonds were issued in Beijing, Shanghai and Guangdong. According to previous market rumors, the planned issuance amount of this round of special refinancing bonds is 1.5 trillion yuan, exceeding the sum of the previous two rounds.

What are the main sources of local debt risks?

Nie Zhuo pointed out that in the short term, the local government debt risk is mainly manifested as liquidity risk, especially the liquidity risk of the stock implicit debt, including a considerable part of financing platform debt, which is due to be paid.The principal repayment risk of local government’s explicit debt is not serious, but the continuous rise of interest burden is worthy of attention.. At present, the liquidity risk of local government debt is very prominent, which is also related to the substantial increase of local government expenditure responsibility during the epidemic, the financial shortage caused by the economic recovery situation after the epidemic, and the real estate risk has not been completely resolved.

"In the long run, the essence of local debt risk is that the transformation of China’s economic development model has not yet been completed, and economic growth still depends on government investment to a considerable extent, and the efficiency of government investment has gradually declined with the completion of a large number of infrastructure construction in the past." Nie Zhuo said that whether the future debt risk can really be continuously resolved depends on whether it can continue to deepen major economic reforms such as market-oriented reform and income distribution reform while improving the local government debt management system, and finally complete the transformation of the economic development model.

It is worth noting that the the Political Bureau of the Communist Party of China (CPC) Central Committee meeting held on July 24th pointed out that "it is necessary to effectively prevent and resolve local debt risks and formulate and implement a debt package". Then, what plans can local governments take to prevent and resolve local debt risks?

Nie Zhuo said that in the short term, the core of debt conversion is to avoid liquidity risks of local governments. Relevant debt-dissolving measures include negotiating with financial institutions to obtain liquidity support, issuing special refinancing bonds, and disposing of state-owned assets to obtain income to pay off debts. In the medium term, while promoting the further improvement of the economic situation to increase the financial revenue sources of local governments, we can consider restructuring some hidden debts. In the long run, on the one hand, it is necessary to further improve the local government debt management mechanism and establish a clear relationship between the central and local governments to avoid the increase of debt scale; On the other hand, it is also necessary to promote the reform of income distribution and marketization to reduce the dependence of economic growth on government investment.

Song Xuetao, chief macro analyst of TF Securities, said in an interview with national business daily that since the meeting of the Political Bureau on July 24th, although local governments have actively promoted the debt-converting work, not many have publicly disclosed the debt-converting plan.

Song Xuetao further pointed out that Hunan Province may mainly rely on financial resources to support debt. On August 29th, the executive meeting of Hunan Provincial Government approved in principle the Work Plan for Preventing and Resolving Local Debt Risks in Hunan Province (Draft for Review), but the plan has not been made public at present. However, from the Report on Draft Final Accounts of Hunan Province in 2022 and Budget Implementation in the First Half of 2023, it is mentioned that "encourage and guide financial institutions such as banks ‘ Take his plate instead ’ , continue to cut interest rates, promote the hidden debt chain, optimize the structure, and reduce costs. From the point of view, the interest rate reduction for the extension of the existing hidden debt may be the key debt-turning scheme in Hunan Province this round.

Xiangtan City, Hunan Province, in the "Report on the Final Accounts of Xiangtan City at the corresponding level in 2022 (Draft)" also proposed "passing ‘ Silver meets non-silver ’ ‘ Bank encirclement ’ , structural deleveraging, optimizing asset allocation and other measures, and strive to achieve ‘ Medium and long-term bank funds accounted for 90% of the debt, and the interest rate dropped to 4%’ The goal of accelerating the realization of ‘ Interest even ’ The plan to promote the early turning point in the tough battle of debt conversion is also mainly based on the route of financial support for debt conversion. Song Xuetao said: "Considering that the explicit debt space of local governments is limited, it is more difficult to replace a large number of implicit debts with explicit debts in 2015. It is expected that financial resources such as interest rate cuts will play a greater role in this round of debt-converting."

Nanning, Guangxi, emphasizes the market-oriented transformation of state-owned enterprises and the revitalization of existing assets to help turn debt into debt. The Work Points of Nanning Finance Bureau in 2023 clearly pointed out that "support the market-oriented transformation of state-owned enterprises and promote the debt resolution of municipal state-owned platform companies. Increase the vitality of the city-level and county (city, district) stock assets, and actively revitalize various assets such as national reserve forests, water conservancy projects, property transfer houses and state-owned agricultural land. "

Which related industries will benefit?

Song Xuetao said that debt conversion through special refinancing bonds is essentially the same as the replacement bonds launched in 2015, which are all implicit debts. By 2022, the explicit debt ratio of local governments has reached 125%, exceeding the warning line of 100% set by the Ministry of Finance in 2015, and there is not much room for local governments to undertake hidden debts. Therefore, the special refinancing bonds will mainly play an "emergency" role in this round of debt conversion, and it is not expected to "sprinkle pepper noodles".

Nie Zhuo also said that special refinancing bonds are conducive to helping areas with high hidden debt risks to reduce the pressure of principal and interest payment.

Feng Lin pointed out that the previous market rumors that the issuance amount of this round of special refinancing bonds will be around 1.5 trillion yuan, and the focus will be on 12 high-risk provinces and cities, but Inner Mongolia, which took the lead in issuing special refinancing bonds, is not among these 12 provinces. This means that the provinces involved in this round of special refinancing bonds may be more widely rumored than before.It is expected that the areas with high risk of subsequent debt will also follow up the issuance quickly, and the current issuance quota may also exceed 1.5 trillion yuan.— — Comparing the local government debt balance and debt limit, the upper limit of the scale of issuing special refinancing bonds to replace hidden debts during the year is about 2.6 trillion yuan, of which the general debt limit space is about 1.4 trillion yuan and the special debt limit space is about 1.1 trillion yuan, and the general debt limit can be used more. The special refinancing bonds issued in Inner Mongolia this time are all general debts.

Which industries may be greatly affected by the new round of local debt risk resolution? What investment opportunities may appear in the second half of the year?

In this regard, Song Xuetao explained that since this round of debt conversion should "prevent debt from being added at the same time", and the creditor should mainly resolve the risk of debt exposure, not eliminate the debt, and the corresponding debt still needs to be repaid by the local government after debt conversion, so the main function of this round of debt conversion will be to slow down the risk, rather than let the local government re-leverage on a large scale. However, in the process of debt conversion, local governments and local urban investment platforms may speed up the repayment of debts owed by enterprises. Therefore, industries that have had more business dealings with local governments in the past and held more accounts receivable from local governments or local urban investment platforms will benefit from this round of debt, such as construction, agriculture, forestry, environmental protection, water affairs, electricity and other industries related to infrastructure or public utilities.

Feng Lin said that the issuance of special refinancing bonds in Inner Mongolia means that the market will realize the expected resumption of the issuance of special refinancing bonds, which will slow down the liquidity risk in areas with high debt risk, and may also release the signal that the debt package plan will gradually enter the implementation stage. This is mainly beneficial to the short-term solvency of urban investment enterprises, and its impact on the bond market is also mainly reflected in urban investment bonds. The reason is that the city investment company, as the investment and financing platform of local governments for a long time, is the main debtor of local hidden debts.

Feng Lin further pointed out that it can be seen that since Politburo meeting of the Chinese Communist Party put forward a package of debt-conversion schemes, the market’s worries about the default of urban investment bonds have been alleviated. Since August, urban investment bonds have been sought after by investors, with the subscription multiple rising sharply, the yield rate dropping significantly, and the spread greatly reduced. In particular, short-term urban investment bonds in areas with high debt risks and regional spreads have been favored by the market, and the spread narrowed most obviously. "We judge that with the gradual implementation of the debt package represented by the re-issuance of special refinancing bonds, the regions and related entities that benefit from policy support will be focused on by the market, and the enthusiasm for the subscription of urban investment bonds is still expected to continue."

Reporter |Songo Intern reporter |Zhang hong

Edit |Sun Zhicheng Liao Dan Du Hengfeng

Proofread |Wang Yuelong